Why a Robust GST Return Filing Checklist Small Business India is Non-Negotiable

For millions of entrepreneurs across India, managing the Goods and Services Tax (GST) framework is a foundational aspect of running a compliant business. While GST simplified the previous maze of indirect taxes, the monthly or quarterly filing requirements, coupled with strict reconciliation rules, can still overwhelm small business owners who lack dedicated accounting teams. Accuracy and timeliness are paramount; even minor errors can lead to hefty penalties and interest.

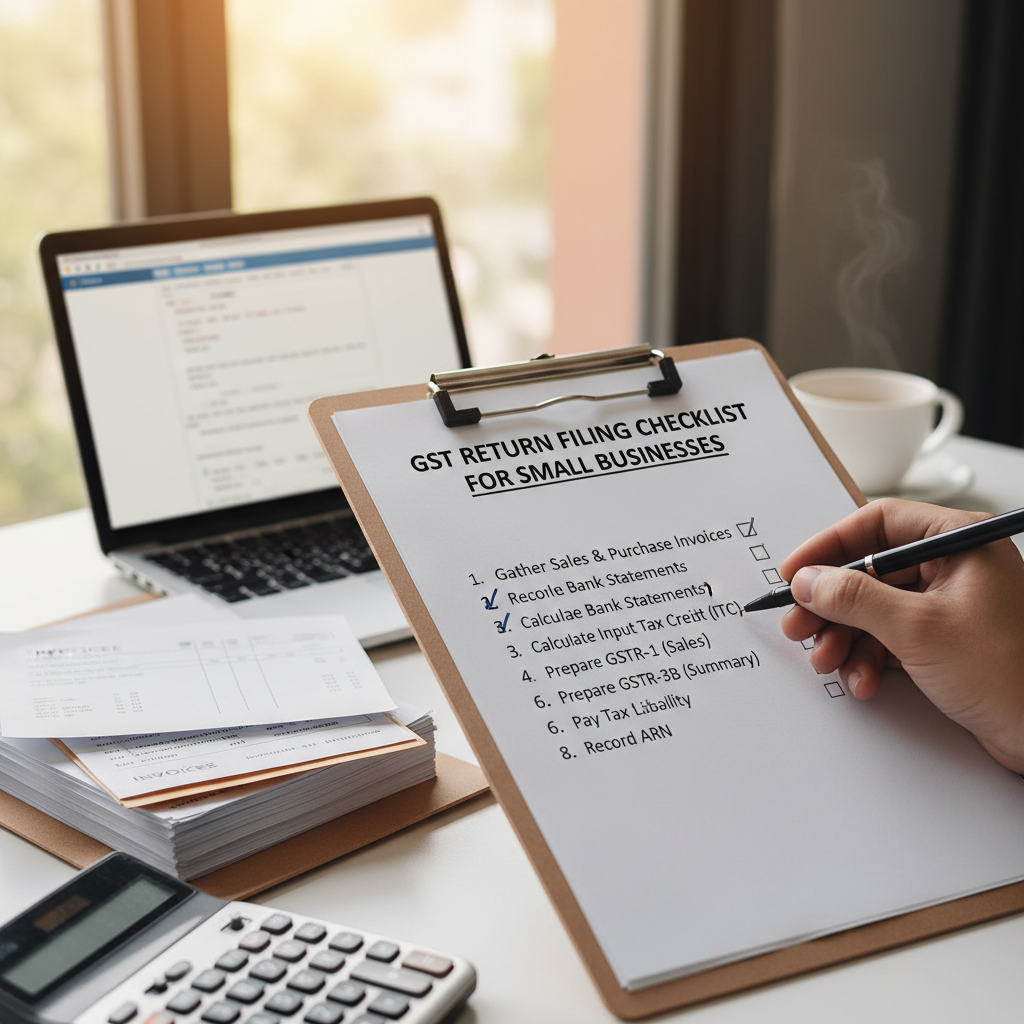

This comprehensive guide provides the ultimate gst return filing checklist small business india needs to ensure seamless compliance, maximize Input Tax Credit (ITC), and maintain a clean record with the tax authorities. By following these structured steps, you can transform the often-dreaded filing process into a routine operational task.

Understanding Your GST Compliance Obligations and Return Types

Before diving into the checklist, every small business must accurately identify its filing frequency and the types of returns applicable based on their turnover and registration scheme.

GSTR-3B: The Summary Return

This is the essential monthly return summarizing sales, purchases, and tax liability (including payment). Most businesses file this monthly, though those under the Quarterly Return Monthly Payment (QRMP) scheme file it quarterly.

GSTR-1: The Sales Detail Return

This return reports detailed outward supplies (sales) made during the period. This data is critical as it populates the GSTR-2A/2B of your customers, allowing them to claim ITC.

GSTR-4: Composition Scheme Filers

Businesses registered under the Composition Scheme file GSTR-4 annually and use Form CMP-08 quarterly for tax payment. Their compliance burden is significantly lower.

Key Preliminary Steps for the GST Return Filing Checklist Small Business India

- Verify Registration Status: Ensure your GST registration is active and the status (normal taxpayer, QRMP, composition) is correctly reflected on the portal.

- Digital Signature Certificate (DSC) / EVC: Ensure your DSC is valid or that the authorized signatory has access to the Electronic Verification Code (EVC) facility.

- Sufficient Funds: Confirm adequate balance in your Electronic Cash Ledger, or prepare for immediate tax payment via Challan (PMT-06).

Phase 1: Documentation and Data Preparation Checklist

The foundation of accurate GST filing rests entirely on meticulous record-keeping. Filing without complete and reconciled data is the fastest route to receiving demand notices.

Essential Documents for the Gst Return Filing Checklist Small Business India

Gathering and classifying the following documents is the first critical step:

- Sales Register: Summarizing B2B, B2C (large and small), Exports, and Exempted sales.

- Purchase Register: Detailed records of all inward supplies, segregated by taxable, exempt, and RCM (Reverse Charge Mechanism) liability.

- Debit and Credit Notes: Documentation for any adjustments made to sales or purchases during the period.

- Bank Statements: Required for reconciliation, especially for verifying the date of supply for services and RCM transactions.

- E-Way Bills: Verification that all required e-way bills for movement of goods have been generated and match the invoices.

Data Hygiene Check

Strongly verify the GSTINs of all your B2B customers and suppliers. Incorrect GSTINs lead to failed ITC claims for your customer and potential penalties for you.

HSN/SAC Code Validation

Ensure that the Harmonized System of Nomenclature (HSN) for goods or Service Accounting Code (SAC) for services is correctly applied, especially if your turnover requires 6-digit or 8-digit reporting.

Phase 2: The Core Reconciliation and Filing Process

GSTR-1 Filing Steps (Outward Supplies)

- Data Segregation: Separate sales data into B2B, B2C, Exports, Zero-rated, and Exempt categories.

- Upload and Verify: Upload the required data tables (e.g., Table 4 for B2B) to the GST portal.

- Amendments: Check for any previous period errors that need correction in Table 9 (Amendments to B2B/Credit Notes).

- Summary Review: Ensure the auto-calculated summary (Table 1 & 13) matches your accounting records exactly.

- File GSTR-1: Submit the return using DSC or EVC before the deadline (usually the 11th of the succeeding month, or 13th for QRMP).

GSTR-3B Filing Steps (Summary and Payment)

GSTR-3B is the most crucial return as it involves tax payment. Accuracy here is vital, particularly concerning Input Tax Credit (ITC) eligibility and utilization.

ITC Reconciliation: The Most Critical Step

Before claiming ITC in GSTR-3B, you must perform a strict reconciliation between your purchase register and the auto-drafted statement, GSTR-2B. GSTR-2B reflects the ITC available based on the returns filed by your suppliers.

- Match 2B vs. Books: Compare every invoice in your purchase register with GSTR-2B.

- Identify Mismatches: Note down any invoices present in your books but missing in GSTR-2B. These missing credits generally cannot be claimed immediately, according to current law, unless the supplier files their return later.

- Reverse Ineligible ITC: Ensure you reverse or do not claim ITC on ineligible items (e.g., restricted goods/services under Section 17(5)).

Calculating your exact tax liability and eligible ITC can be complex. Utilizing reliable tools ensures accuracy. You can use a dedicated GST Calculation Tool to verify your final tax payable before filing.

Final GSTR-3B Checklist

- Verify Liability: Ensure Table 3.1 (Outward Supplies) matches the liability reported in GSTR-1.

- Confirm ITC Claim: Enter the reconciled ITC amount in Table 4.

- RCM Liability: If applicable, ensure RCM liability is reported and paid (Table 3.1(d)).

- Offset Liability: Utilize available ITC first, then use the balance in the Electronic Cash Ledger.

- Generate Challan: If the cash ledger is insufficient, generate and pay the required Challan (PMT-06).

- Submit GSTR-3B: File the return using DSC or EVC (usually by the 20th of the succeeding month).

Navigating Common Pitfalls and Deadlines for Small Businesses

Compliance hinges on adherence to deadlines. Missing dates, even by a day, triggers statutory late fees and interest, significantly impacting the working capital of a small business.

Key Monthly Deadlines (Normal Taxpayers)

- GSTR-1: 11th of the succeeding month.

- GSTR-3B: 20th of the succeeding month.

Note: Deadlines for GSTR-3B can vary (22nd or 24th) depending on the state, especially for smaller taxpayers.

Penalties and Interest

Late filing of GSTR-3B incurs a late fee (currently capped, often Rs. 50 per day). Furthermore, delayed tax payment incurs interest at 18% per annum. Timeliness is key to protecting your margins.

“In the world of tax compliance, procrastination is the most expensive habit. Ensuring that the data uploaded by the 11th (GSTR-1) is accurate directly determines the accuracy of the tax paid by the 20th (GSTR-3B).”

Phase 3: Post-Filing Activities and Audit Preparedness

Filing the return is not the end of the compliance cycle. Maintaining proper records and performing continuous reconciliation is vital for future audits and annual returns.

Continuous Reconciliation and Record Maintenance

A diligent gst return filing checklist small business india uses includes post-filing steps:

1. GSTR-2A/2B Monitoring

After filing GSTR-3B, continuously monitor GSTR-2A/2B to see if any suppliers who were late in filing have now uploaded their invoices. If they appear, you may claim the missed ITC in a subsequent month, provided all conditions under Section 16 are met.

2. Annual Return (GSTR-9/9C) Preparedness

The Annual Return requires a detailed reconciliation between the filed monthly/quarterly returns and your audited financial statements. Maintaining clear, organized ledgers throughout the year simplifies this complex annual process dramatically.

3. Documentation Storage

GST law mandates the retention of all invoices, debit/credit notes, and supporting documents for a minimum period of 72 months (six years) from the due date of filing the Annual Return for the financial year. Ensure both digital and physical records are systematically archived.

For more detailed information regarding statutory compliance requirements and official notifications, businesses should regularly consult the official Central Board of Indirect Taxes and Customs (CBIC) website.

Summary of the Ultimate GST Return Filing Checklist Small Business India

To summarize, successful GST compliance relies on consistency, reconciliation, and timely action. This checklist ensures that no crucial step is missed, safeguarding your business from avoidable tax liabilities and penalties.

Pre-Filing Check

Verify GSTINs, HSN/SAC codes, and ensure all ledgers are updated and balanced.

Sales Reporting (GSTR-1)

File sales details accurately by the 11th. Ensure B2B details are correct for customer ITC.

ITC Reconciliation

Strictly match purchase data with GSTR-2B. Claim only eligible, reconciled ITC.

Payment & Filing (GSTR-3B)

Pay tax and file GSTR-3B by the 20th. Do not miss this deadline to avoid 18% interest.

Post-Filing Action

Monitor GSTR-2A/2B for future ITC claims and archive all supporting documentation.

Adopting a proactive approach to tax management not only ensures compliance but also provides a clearer financial picture of your business operations. For ongoing updates and professional guidance on tax matters, referring to reliable financial news sources, such as the Mint (Livemint) tax and finance section, can be highly beneficial.

Conclusion

For a small business in India, mastering GST return filing is a crucial step towards sustainable growth and financial stability. By diligently utilizing this gst return filing checklist small business india guide, you minimize the risk of penalties, optimize your Input Tax Credit, and ensure your business remains fully compliant with the stringent requirements of the GST regime. Consistency and accuracy are your best defenses against future tax scrutiny.

FAQs

GSTR-1 reports the details of your outward supplies (sales). It is a statement of details but does not involve tax payment. GSTR-3B is the summary return that reports total liability, eligible ITC, and involves the actual payment of tax for the period.

The primary way to avoid late fees is to adhere strictly to the prescribed deadlines (11th for GSTR-1 and 20th/22nd/24th for GSTR-3B). Set reminders and ensure that the reconciliation process is completed well before the due date, allowing time for tax payment.

If the tax liability reported in GSTR-3B is less than the liability reported in GSTR-1, the taxpayer will receive a discrepancy notice. This mismatch often leads to penalties and interest on the differential amount. It is mandatory to ensure these two returns are reconciled before filing GSTR-3B.

While previously there was some flexibility, current rules stipulate that ITC can generally only be claimed if it is reflected in GSTR-2B, subject to specific regulatory tolerances. Small businesses must proactively follow up with suppliers to ensure they file their GSTR-1 promptly so the credit appears in GSTR-2B.

The Quarterly Return Monthly Payment (QRMP) scheme allows businesses with an aggregate annual turnover up to Rs. 5 crore to file GSTR-1 and GSTR-3B quarterly, significantly reducing the compliance frequency. However, tax payment still needs to be made monthly via Form PMT-06.