Securing Your Future: Understanding the Post Office FD Landscape for 2025

In an environment where market volatility often dictates financial outcomes, the appeal of secure, government-backed savings schemes remains incredibly strong. For millions of conservative investors in India, the Post Office Time Deposit (POTD), often referred to simply as a Post Office FD, is a cornerstone of their financial planning. It offers predictable returns and the unparalleled security of sovereign guarantee.

If you are planning your investments for the upcoming financial year, understanding how to accurately project your returns is crucial. This comprehensive guide will walk you through the mechanisms of POTD rates, explain the importance of timely rate reviews, and show you exactly how to utilize a Post Office FD Calculator to determine your future wealth. By the end of this article, you will be proficient in navigating the complex details surrounding post office fd interest rates 2025 calculator usage and maximizing your savings.

The interest rates for these small savings schemes are reviewed quarterly by the Ministry of Finance, meaning that while rates are stable for a three-month period, they are subject to change based on government bond yields and prevailing economic conditions. Therefore, staying updated on the official quarterly announcements is essential for anyone relying on these instruments for long-term growth.

Decoding Post Office Time Deposits (POTD): Why They Remain Popular

The Post Office Time Deposit scheme operates much like a bank Fixed Deposit, but it is managed through the extensive network of India Post. The primary reason for its sustained popularity is the inherent safety it provides. Unlike bank FDs, which are insured up to a certain limit (currently ₹5 lakh per bank by DICGC), POTD schemes carry the backing of the Government of India, offering complete peace of mind, irrespective of the investment size.

Key Features and Security

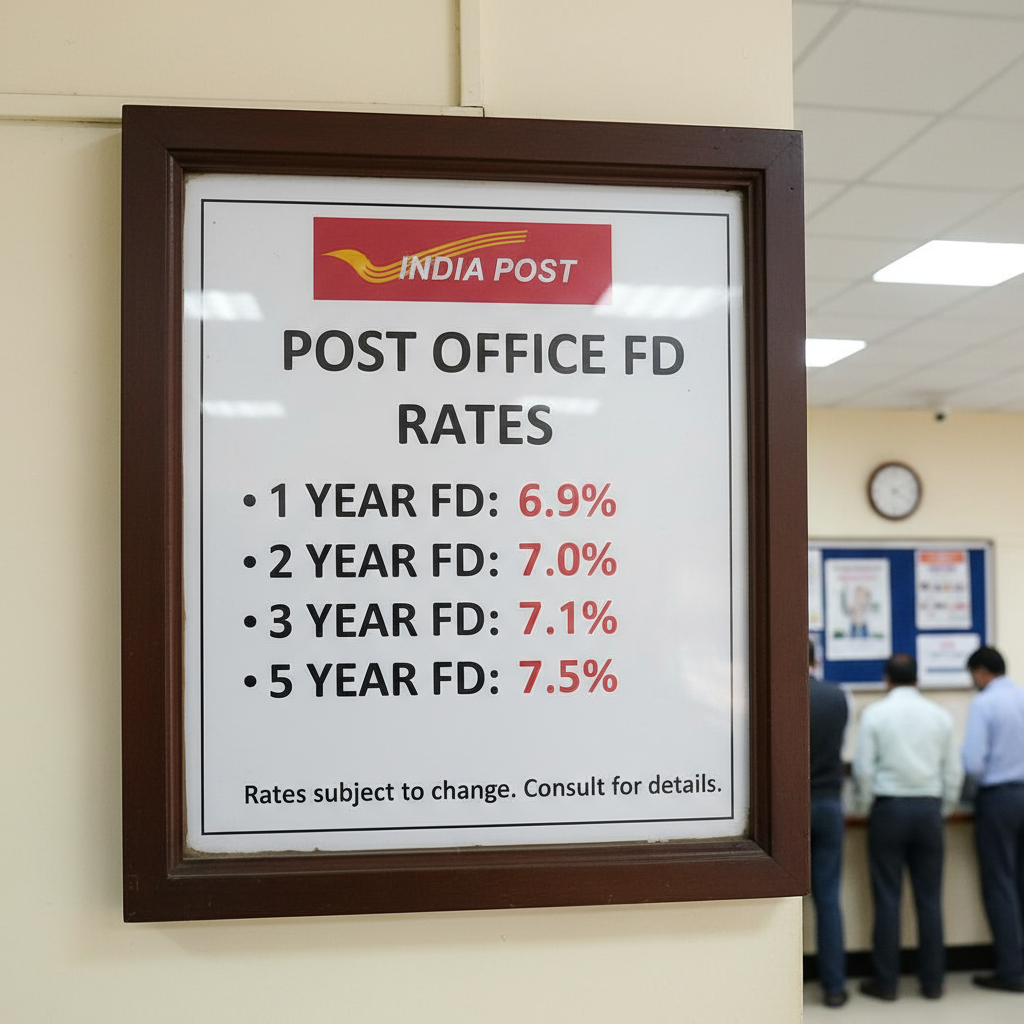

POTD accounts can be opened with a minimum deposit of just ₹1,000, making them highly accessible to individuals across all income brackets. They are available in four primary tenures: 1 year, 2 years, 3 years, and 5 years. Interest is calculated annually but is paid out annually or credited back to the account, depending on the scheme rules and investor preference.

Sovereign Security

Investment is guaranteed by the Government of India, offering zero credit risk—a crucial advantage over private sector investments.

Tax Efficiency (5-Year TD)

The 5-year POTD qualifies for deductions under Section 80C of the Income Tax Act, providing a dual benefit of safety and tax saving.

Widespread Accessibility

With thousands of post offices nationwide, opening and managing a POTD account is easy, even in remote areas without strong bank presence.

Understanding the Current Post Office FD Interest Rates 2025 Calculator Framework

The interest rates applicable to Post Office FDs are not fixed indefinitely; they are dynamic, tied to the quarterly review cycle. While we cannot predict the exact rates for every quarter of 2025, the rates are generally benchmarked to the yield on Government Securities (G-Secs) of similar maturity, with a slight spread added. This mechanism ensures that the rates offered remain competitive yet sustainable for the government.

For investors planning in 2025, it is vital to remember that once you book a Time Deposit, the rate applicable at the time of deposit remains fixed for the entire tenure. This locking-in feature is one of the primary attractions, guaranteeing stable returns regardless of future economic shifts or rate cuts. It removes the uncertainty associated with floating rate instruments.

Rate Comparison: Post Office vs. Banks

Historically, when the economy faces stress or interest rates are generally low, small savings schemes like the POTD often offer rates that are marginally higher than those offered by major commercial banks on similar tenure FDs. This competitive edge makes them particularly attractive during periods of monetary easing.

According to the official guidelines released by the Ministry of Finance, the interest rates on small savings schemes are generally aligned with market rates but adjusted to promote savings among the general public. You can refer to the official India Post website for the most recent official quarterly rate notifications.

Maximizing Returns: Utilizing the Post Office FD Interest Rates 2025 Calculator

When planning a long-term investment, the final maturity amount is the most important figure. Since POTD interest is calculated annually but compounded quarterly, manually calculating the final return, especially for 5-year deposits, can be complex and prone to error. This is where a dedicated calculator becomes indispensable.

The primary function of the post office fd interest rates 2025 calculator is to provide an accurate projection of the maturity value based on three key inputs: the principal amount, the tenure, and the prevailing interest rate. Using such a tool ensures you make informed decisions about how much to invest and for how long to meet specific financial goals, such as funding a child’s education or securing retirement corpus.

Input Factors for Calculation

- Principal Amount (P): The initial lump sum invested.

- Interest Rate (R): The locked-in rate for the chosen tenure.

- Time Period (T): The tenure in years (1, 2, 3, or 5).

- Compounding Frequency (N): Annually calculated, but often compounded quarterly in practice for POTD schemes.

Example Scenario

Suppose the 5-year rate is 7.5%.

If you invest ₹5,00,000 for 5 years, the calculator will show the total interest earned (approximately ₹2,16,000) and the final maturity amount (₹7,16,000). This precision allows for accurate planning.

Why Compounding Matters in POTD

While the interest is paid annually to the investor, the calculation often involves quarterly compounding. This compounding effect, where interest is earned on previously earned interest, significantly boosts the final yield over longer tenures, particularly the 5-year option. When using a post office fd interest rates 2025 calculator, ensure the compounding frequency assumption matches the scheme’s official rules.

Tenure Options and Compounding Benefits

Choosing the right tenure is critical. While shorter tenures (1-year and 2-year) offer liquidity, the longest tenure (5-year) typically offers the highest interest rate and the added benefit of tax deduction under Section 80C.

1-Year TD

Highest liquidity. Suitable for short-term goals. Rates are usually the lowest among the four options.

2 & 3-Year TD

Mid-range option. Better rates than 1-year, but still allows access to funds before the 5-year lock-in.

5-Year TD

Maximum interest rate and Section 80C tax benefits. Ideal for long-term, tax-efficient savings.

The Tax-Saving Power of the 5-Year TD

The 5-Year Post Office Time Deposit is particularly attractive because it is one of the few fixed-income, government-backed products that offer tax benefits. An individual can claim a deduction of up to ₹1.5 lakh per financial year under Section 80C by investing in this specific tenure. This significantly enhances the effective yield for taxpayers in higher slabs.

“The stability and tax advantage of the 5-year Post Office Time Deposit make it a foundational asset for conservative retirement planning, providing predictable growth untouched by market fluctuations.”

Navigating Taxation and Withdrawal Rules

While the POTD schemes themselves are secure, the interest earned is fully taxable according to the investor’s income tax slab. This is a critical point of difference from schemes like the PPF (Public Provident Fund), where interest is entirely tax-exempt.

TDS Implications

If the interest earned on your POTD exceeds ₹40,000 (₹50,000 for senior citizens) in a financial year, the Post Office will deduct Tax Deducted at Source (TDS) at a rate of 10%. Investors who expect their total annual income to fall below the taxable limit should submit Form 15G (or 15H for senior citizens) at the beginning of the financial year to prevent TDS deduction.

For detailed rules regarding TDS and taxability on fixed deposits, it is advisable to consult the official Income Tax Department of India website.

Premature Withdrawal Penalties

Liquidity is limited in POTDs, especially for the 5-year tax-saving deposit. While premature withdrawal is possible after 6 months, penalties apply:

- Withdrawal after 6 months but before 1 year: Interest is calculated at the Post Office Savings Account rate (usually lower) instead of the contracted TD rate.

- Withdrawal after 1 year: Interest will be calculated at 2% less than the rate prescribed for a TD of the completed tenure (e.g., if you withdraw a 3-year TD after 2 years, the rate applied will be 2% less than the 2-year TD rate).

Strategic Planning for 2025: Leveraging the Interest Rate Cycle

As we approach 2025, economic indicators suggest that interest rates might fluctuate based on global and domestic monetary policies. For investors, timing the investment is often a strategic choice.

If you anticipate rate hikes, it might be beneficial to keep funds liquid and wait for the quarterly rate announcement. Conversely, if you believe rates have peaked, locking in a higher rate with a 5-year POTD immediately is the best strategy. Always confirm the latest official post office fd interest rates 2025 calculator inputs before making a deposit.

Step 1: Rate Confirmation

Always verify the official POTD rates for the current quarter before initiating the deposit.

Step 2: Goal Alignment

Match the POTD tenure (1, 2, 3, or 5 years) to your specific financial requirement timeline.

Step 3: Calculator Use

Use a reliable Post Office FD Calculator to precisely forecast your expected maturity returns.

Step 4: Tax Compliance

Submit Form 15G/15H if applicable to avoid unnecessary TDS deductions on interest income.

The Post Office FD remains a foundational investment for those prioritizing security and guaranteed income. By understanding the quarterly review cycle and leveraging tools like the post office fd interest rates 2025 calculator, investors can efficiently manage their savings portfolio and achieve their financial targets with confidence.

Conclusion

Investing in the Post Office Time Deposit scheme provides a powerful combination of sovereign security and competitive interest rates, making it an indispensable tool for risk-averse investors. As you plan your finances for 2025, remember that accurate calculation is key to maximizing benefits. By consistently monitoring the quarterly interest rate announcements and using a reliable calculator to project maturity values, you ensure that your savings are working optimally for your future goals. The POTD is not just an investment; it is a commitment to financial stability backed by the strongest guarantee available.

FAQs

Post Office FD (Time Deposit) interest rates are reviewed and potentially revised quarterly by the Ministry of Finance, Government of India. Once you book a deposit, however, the rate is locked in for the entire duration of that specific deposit.

Yes, the interest earned on Post Office FDs is fully taxable in the hands of the investor according to their applicable income tax slab. If the annual interest exceeds ₹40,000 (or ₹50,000 for senior citizens), TDS (Tax Deducted at Source) will be applied.

No. Only the 5-Year Post Office Time Deposit qualifies for tax deduction benefits under Section 80C of the Income Tax Act, up to the prescribed limit of ₹1.5 lakh per financial year.

The minimum investment required to open a Post Office Time Deposit account is ₹1,000. There is generally no upper limit on the maximum investment, although tax benefits are capped under 80C rules for the 5-year deposit.

The calculator allows you to input the principal amount, tenure, and prevailing interest rate to accurately determine the final maturity value and the total interest earned, facilitating precise financial planning for 2025 and beyond.

Yes, premature withdrawal is allowed after six months, but penalties apply. Withdrawal before one year results in interest being paid at the basic Post Office Savings Account rate. After one year, the interest rate is reduced by 2% from the rate applicable to the completed tenure.