Let’s be real for a second. Most people treat an EMI calculator like a toy. They punch in a few numbers, look at the monthly payment, nod their head, and sign away the next 20 years of their financial freedom.

I’ve spent the last decade working in financial strategy, and I’ve seen this scenario play out more times than I care to count. A client walks in, proud of the “affordable” monthly payment they secured, only for me to show them they’re paying double the asset’s value in interest over the loan term. It’s heartbreaking. And it’s entirely preventable.

In 2026, with interest rates fluctuating and the cost of living squeezing budgets tight, you cannot afford to be passive. An EMI calculator isn’t just a number-crunching tool; it is your primary weapon against the banking system’s profit margins.

This isn’t about basic math. This is about leverage. By the end of this guide, you’ll know exactly how to manipulate loan variables to save thousands of dollars and keep yourself out of the debt spiral.

📑 What You’ll Learn

1. The 40% Rule: Your Financial Safety Net

Here is the golden rule of borrowing in 2026: Never commit to an EMI that pushes your total debt-to-income ratio above 40%.

I know, banks will tell you that you qualify for more. They might approve you for up to 50% or even 60% of your net income. Do not take the bait. When you max out your borrowing capacity, you are one medical emergency or one car repair away from a financial crisis.

When using an EMI calculator, don’t just look at the new loan. You need to stack it on top of your existing obligations.

⚠️ Watch Out

The “Gross vs. Net” Trap: Lenders often calculate eligibility based on your gross salary (before taxes). Never do this. Always run your EMI calculator numbers using your net take-home pay. The bank doesn’t care about your tax bill, but your bank account certainly does.

If you earn $5,000 a month after taxes, your total EMIs (car, house, credit cards combined) should never exceed $2,000. If the calculator shows your new home loan pushes you to $2,500, you are house poor. Walk away or increase your down payment.

2. The “Iceberg Effect” of Amortization

This is where the banks make their money. Most borrowers look at the EMI amount and ignore the composition of that payment.

In the early years of a long-term loan, your payments are front-loaded with interest. It’s like an iceberg; you see the payment, but you don’t see that 80% of it is just servicing debt, not building equity.

I always advise clients to look at the Total Interest Payable field on the calculator before looking at the monthly payment. Let’s look at the numbers.

| Loan Scenario ($200k @ 8%) | Monthly EMI | Total Interest Paid | Total Cost of Loan |

|---|---|---|---|

| 15-Year Tenure | $1,911 | $144,035 | $344,035 |

| 30-Year Tenure | $1,468 | $328,310 | $528,310 |

Look at that table closely. By extending the loan to 30 years to save roughly $440 a month, you end up paying an extra $184,000 in interest. You are essentially buying the house twice.

🎯 Key Takeaway

The “lowest monthly payment” is often the most expensive product. Use the EMI calculator to find the shortest tenure you can comfortably afford, not the longest one the bank allows.

3. Step-by-Step: How to Stress-Test Your Loan

In my experience, the biggest mistake people make is calculating for the “best-case scenario.” They assume their income will rise and interest rates will stay flat. In 2026, that’s a dangerous gamble.

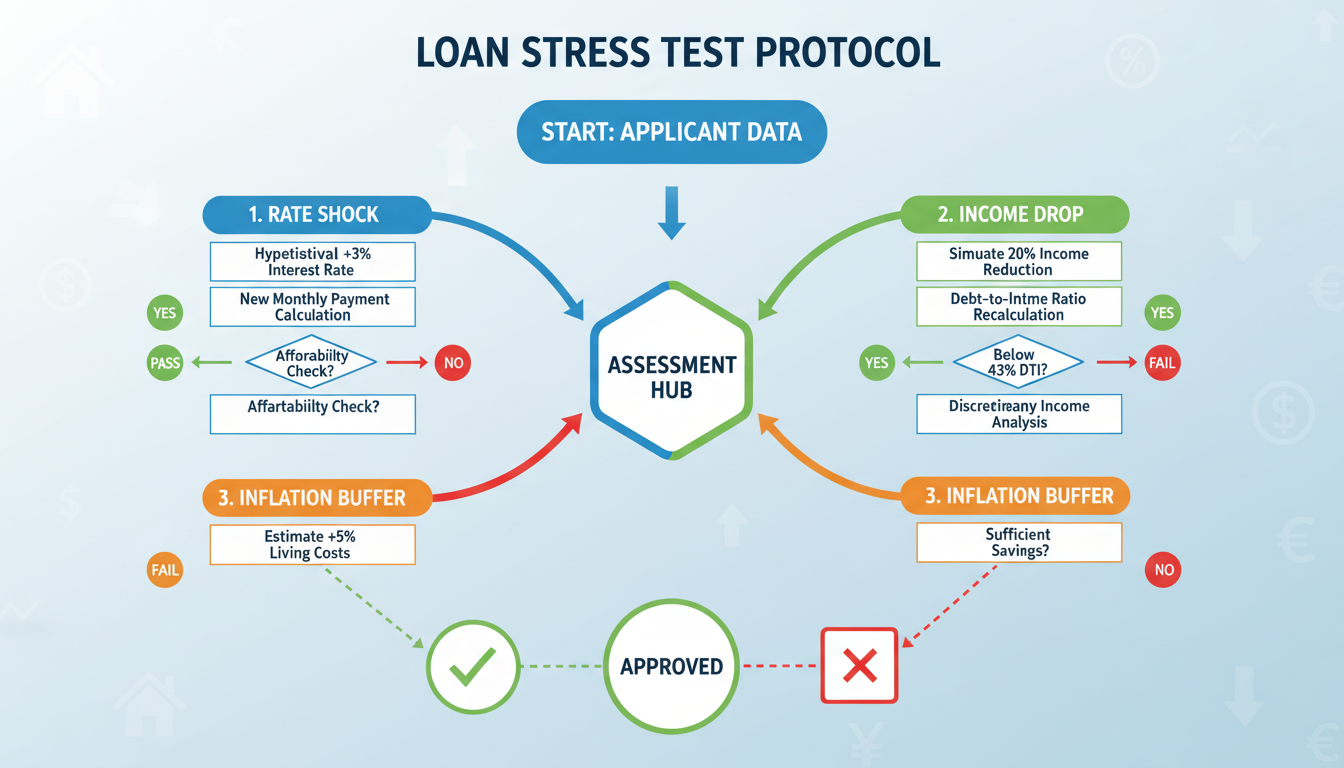

Here is my personal protocol for stress-testing a loan before signing the papers. Follow these steps on your calculator:

- Calculate the Baseline: Input your principal, current interest rate, and desired tenure. Note the EMI.

- The “Rate Shock” Test: Increase the interest rate by 2%. If you’re getting a loan at 7%, calculate it at 9%. Can you still afford the EMI without eating ramen noodles every night? According to the Federal Reserve, rate volatility is a constant factor in modern economics. Be ready for it.

- The Income Drop Test: Assume your household income drops by 20% (loss of a bonus, overtime, or a spouse taking a pay cut). Does the EMI still fit within 50% of this reduced income?

- The Inflation Buffer: Add 10% to the EMI mentally. This covers insurance premiums and property taxes, which almost always go up over time.

4. The Flat Rate Trap & Hidden Costs

This is a dirty trick that is still prevalent in auto loans and personal loans. A lender might quote you a “Flat Interest Rate” of 8%. It sounds great compared to a “Reducing Balance Rate” of 10%, right?

Wrong. Dead wrong.

A flat rate calculates interest on the entire principal for the entire tenure, never accounting for the money you’ve already paid back. A reducing balance rate (which is standard for mortgages) only charges interest on what you currently owe.

💡 Pro Tip

The Conversion Rule: As a rule of thumb, a Flat Rate is roughly equivalent to nearly double the Reducing Balance rate. If a dealer offers you a 6% flat rate, that is effectively an 11-12% reducing rate. Always use an EMI calculator that specifies “Reducing Balance” to see the real cost.

Reverse Engineering Your Budget

Most people work forward: “I want this $50,000 car. What’s the EMI?”

I want you to work backward. This is called Reverse Affordability.

Start with your budget. “I can afford $600 a month.” Input that into the calculator along with the tenure and interest rate to solve for the Principal amount. This tells you exactly how much car or house you can buy. If the number is lower than you hoped, you have two choices: save for a bigger down payment or lower your expectations. Do not stretch the budget.

5. Advanced Repayment Hacks

Once you have your loan, the EMI calculator becomes a strategic planning tool. You can use it to shave years off your debt.

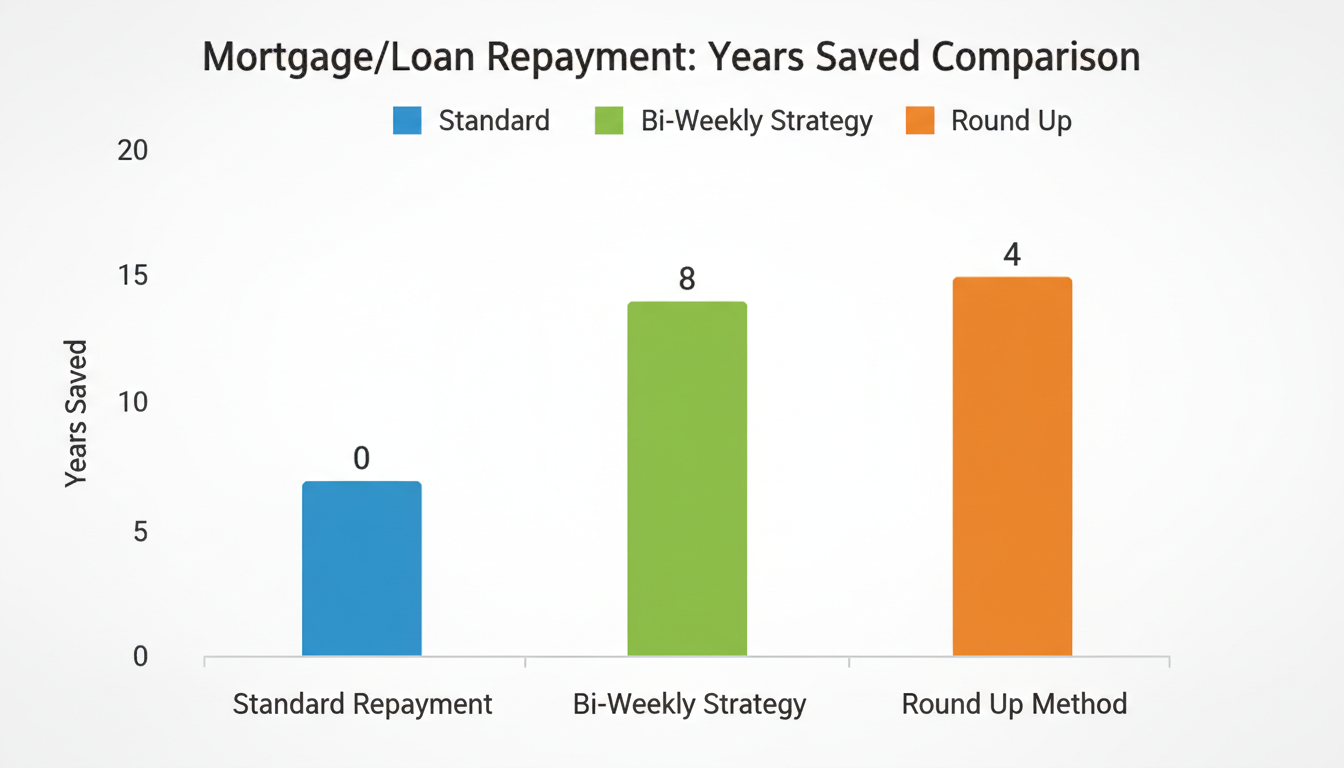

The Bi-Weekly Payment Strategy

Instead of paying monthly, ask your lender if you can pay half your EMI every two weeks. Since there are 52 weeks in a year, you end up making 26 half-payments. That equals 13 full payments per year.

That one extra payment a year goes 100% toward the principal. On a 30-year mortgage, this single trick can knock 4 to 6 years off your loan term. It’s magic, but it’s just math.

The “Round Up” Method

Let’s say your calculated EMI is $1,420. Round it up to $1,500. That extra $80 might seem insignificant, barely the cost of a nice dinner out. But over 20 years? That small overpayment combats the compound interest significantly. Use the “Prepayment” section of your calculator to see how this small change moves your debt-free date closer.

❓ Frequently Asked Questions

Does checking my EMI eligibility affect my credit score?

No. Using an online EMI calculator is a purely informational tool. It does not trigger a “hard inquiry” on your credit report. You can run as many scenarios as you like without any impact on your score. However, formally applying for the loan with a bank will trigger an inquiry.

Should I choose a floating or fixed interest rate in 2026?

This depends on the economic forecast. Generally, if rates are historically low, lock in a fixed rate. If rates are high and expected to drop (as predicted by many analysts for late 2026), a floating rate might save you money in the long run. Use the calculator to model both scenarios.

What is the difference between EMI and Pre-EMI?

Pre-EMI is interest paid only on the disbursed amount of a loan (common in under-construction properties), while the principal repayment hasn’t started. Full EMI covers both principal and interest. Pre-EMI payments are lower but don’t reduce your debt burden.

Can I trust online EMI calculators 100%?

They are accurate for the math, but they often exclude processing fees, insurance, and documentation charges. Always treat the calculator’s result as a baseline estimate, not the final penny-perfect figure. For precise details, consult Investopedia’s guide on EMI components.

Final Thoughts: Take Control

Debt is a tool, like fire. Controlled, it heats your home; uncontrolled, it burns it down. The EMI calculator is your thermostat.

Don’t rush this process. Spend an hour tonight playing with the numbers. Test the worst-case scenarios. Look at the total interest. By applying these EMI calculator tips, you aren’t just planning a loan; you are securing your future self against stress and financial instability.

Ready to crunch the numbers? Scroll back up, open the calculator, and start designing a repayment plan that works for you, not the bank.