The Savvy User’s Guide: 9 Real-World Uses of a Currency Converter That Save You Money

Let me tell you a quick story. A few years ago, I was standing in a bustling market in Marrakesh, about to buy a beautiful handmade leather bag. The vendor quoted me a price in Euros. It sounded reasonable. But something told me to pull out my phone. I quickly checked the price in Moroccan Dirham against my home currency. The verdict? I was about to overpay by nearly 40%. I showed the vendor the real-time rate, we had a friendly haggle, and I walked away with the bag for a fair price. That simple, 10-second check saved me over $50.

This isn’t just a travel story; it’s a perfect illustration of a powerful financial truth in our connected world: understanding currency is a superpower. And the tool that unlocks this power isn’t some complex financial software. It’s the humble currency converter. But here’s the thing most people miss: thinking of it as just a ‘calculator’ is like thinking of a smartphone as just a ‘telephone’. You’re leaving incredible value on the table. The most important uses of a currency converter aren’t just about math; they’re about making smarter decisions, avoiding hidden fees, and protecting your hard-earned money.

First, Let’s Get One Thing Straight: The Mid-Market Rate vs. Reality

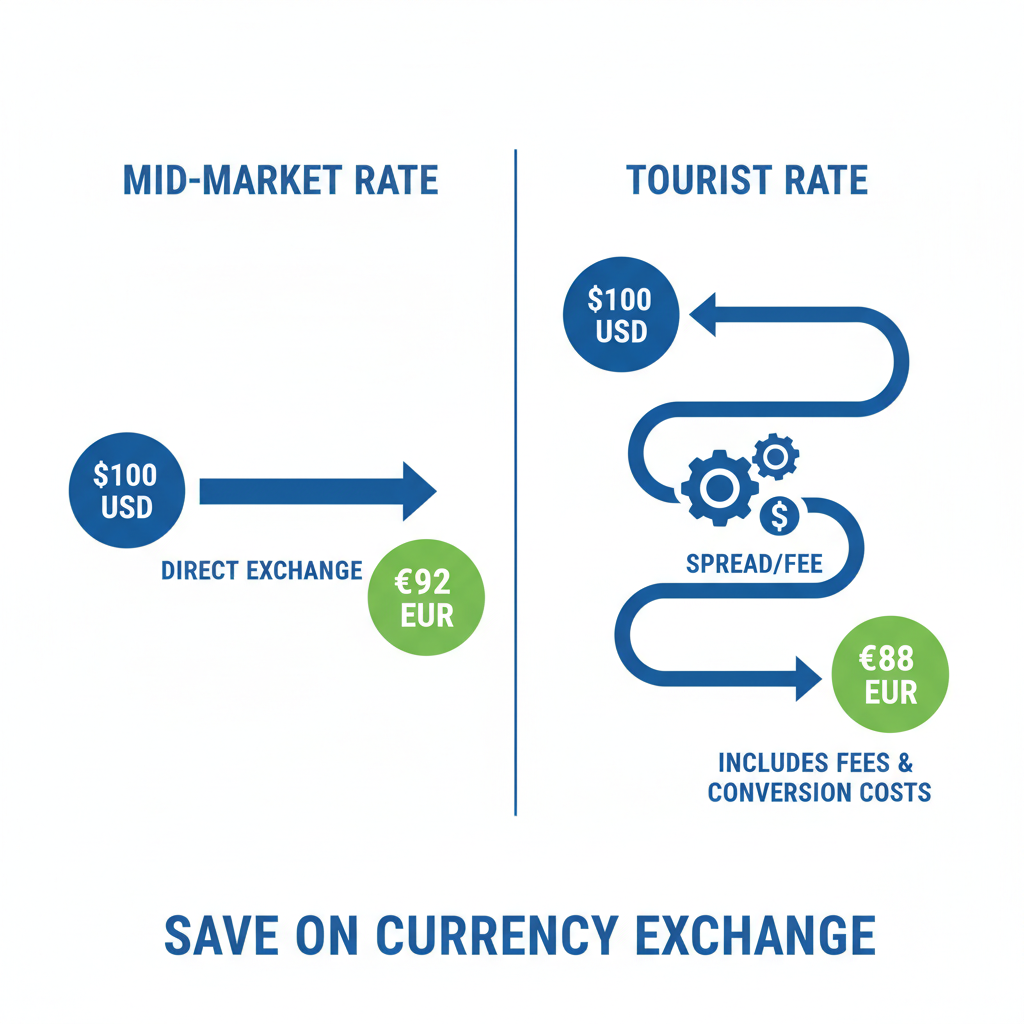

Before we dive into the specific uses, we need to clear up the single biggest misconception about currency converters. The rate you see on a Google search or a standard converter app is called the mid-market rate. Think of it as the ‘wholesale’ price of a currency—the exact midpoint between what banks are willing to buy it for and sell it for. It’s the purest, most accurate rate there is.

But it’s almost never the rate you’ll actually get. Why? Because banks, credit card companies, and currency exchange kiosks need to make a profit. They do this by adding a ‘spread’ or margin to the mid-market rate. They buy currency from you at a rate *below* mid-market and sell it to you at a rate *above* mid-market. That difference is their fee.

Now that we’ve established that, let’s explore the powerful, money-saving uses of a currency converter for every aspect of your global life.

For the Savvy Traveler: Your Shield Against Tourist Traps

For anyone traveling abroad, a currency converter app on your phone is non-negotiable. It’s as essential as your passport. Here’s how to use it like a pro.

1. Budgeting with Psychological Precision

When you’re dealing with a currency where 50,000 units buys you a cup of coffee (like the Indonesian Rupiah), it’s easy to fall into the “Monopoly money” trap. The numbers feel so disconnected from reality that you lose your sense of value and overspend. A currency converter grounds you.

Before your trip, create a quick reference chart for common costs:

- Coffee: 50,000 IDR = ~$3.25 USD

- Taxi Ride: 150,000 IDR = ~$9.75 USD

- Nice Dinner: 750,000 IDR = ~$48.70 USD

By anchoring these foreign prices to your home currency, you re-establish their real-world value. That 750,000 IDR dinner doesn’t feel like a funny number anymore; it feels like a $50 meal, allowing you to make a conscious spending decision.

2. Defeating Dynamic Currency Conversion (DCC) Scams

Have you ever been at a foreign shop or restaurant and the card machine asks if you want to pay in your home currency (e.g., USD) or the local currency (e.g., Euros)? This is called Dynamic Currency Conversion (DCC). It seems helpful, but it’s a trap.

When you choose your home currency, you’re giving the merchant’s bank permission to invent its own, often terrible, exchange rate. Research from financial advisory firm FairFX found that DCC can add up to 7-12% in extra costs to your bill. A currency converter is your weapon here. You can quickly see what the real cost should be and confidently choose to pay in the local currency, letting your own bank (which almost always offers a better rate) handle the conversion.

3. Spotting Rip-Off Exchange Kiosks Instantly

Airport exchange counters are notorious for offering the worst rates. They prey on tired, newly-arrived travelers. Before you even approach a counter, do a quick check on your currency converter app for the live mid-market rate. If the kiosk’s ‘buy’ rate is more than 5-7% worse than the mid-market rate, walk away. You’re better off withdrawing a small amount from a local ATM.

For the Global Online Shopper: Unlocking International Bargains

The internet has made the world one big marketplace. But are you getting the best price? Here are the uses of a currency converter for e-commerce.

4. Finding the True Price on International Websites

Many international e-commerce sites (like Amazon.co.uk or a boutique in France) will detect your location and show you prices in your home currency. This is just another form of DCC. The price they show you in USD is often inflated.

Here’s the expert move:

1. Use your currency converter to check the item’s price in its native currency (e.g., GBP or EUR).

2. Compare that real-time conversion to the USD price the website is showing you.

3. Often, you’ll find it’s cheaper to go through checkout and pay in the seller’s local currency, using a credit card with no foreign transaction fees. I’ve personally saved over 10% on electronics and clothing with this simple trick.

5. Tracking International Price Drops

Exchange rates fluctuate daily. A product that seems expensive today might become a bargain next week if your currency strengthens. If you have your eye on a big-ticket item from an overseas store, use a currency converter with a historical data feature. You can see the price trend over the last 30 days and decide if it’s a good time to buy or if you should wait for a more favorable rate.

For Businesses, Freelancers, and Remote Teams: The Bedrock of Global Operations

In the world of global business, currency isn’t just a detail; it’s a critical factor that can make or break your profitability. Ignoring the uses of a currency converter is simply not an option.

6. Accurate Invoicing and Fair Payroll for Global Teams

If you’re a freelancer invoicing a client in another country, or a company paying a remote team, how do you handle currency? Agreeing to a fixed amount in the client’s currency (e.g., €5,000) exposes you to risk. If the Euro weakens against the Dollar, you get paid less than you expected.

A smart strategy is to peg your invoices to your home currency or a stable currency like the USD. A currency converter becomes essential for this. You can state on your invoice: “€5,000 (equivalent to $5,450 USD based on the mid-market rate on [Date]). Payment to be the equivalent of $5,450 USD on the date of transfer.” This creates transparency and protects your income from volatility.

7. Strategic Pricing for Imports and Exports

Imagine you run a business that imports coffee beans from Colombia (priced in COP) and sells roasted coffee in the United States (priced in USD). Your entire profit margin lives inside the USD/COP exchange rate. If the dollar weakens, your cost of goods skyrockets overnight, potentially erasing your profits.

Businesses use currency converters daily, even hourly, to monitor these rates. This data informs crucial decisions:

* **Dynamic Pricing:** Should we adjust our retail price to account for a weaker dollar?

* **Hedging:** Should we lock in a future exchange rate with a financial instrument?

* **Supplier Negotiation:** Can we negotiate better payment terms with our Colombian supplier?

Without a constant, accurate view of the exchange rate, a business is flying blind.

For Investors and Financial Planners: Managing Global Portfolios

If you invest in international stocks, bonds, or real estate, you have an added layer of risk: currency risk. A currency converter is your primary tool for monitoring it.

8. Calculating the True Return on Foreign Assets

Let’s say you bought shares in a German company, and the stock price went up 10% in one year. A great success, right? Maybe not. What if, during that same year, the Euro fell 12% against the US Dollar? When you convert your ‘profit’ back to dollars, you’ve actually lost 2%. Your investment went up, but your real-world return is negative.

Astute investors use a currency converter constantly to re-value their foreign holdings in their base currency. This gives them a true picture of their portfolio’s performance, stripped of currency illusions. It helps them decide whether to sell a foreign asset or hedge their currency exposure.

9. Identifying Opportunities in Forex Trading

For active Forex traders, the currency converter is the speedometer, the fuel gauge, and the GPS all in one. They use it to:

* Calculate pips (the tiny price movements in a currency pair).

* Determine position sizing and risk management.

* Analyze potential profit or loss on a trade in their base currency.

While this is an advanced use case, it highlights how central the tool is to the world’s largest financial market, where over $7.5 trillion is traded daily, according to the Bank for International Settlements (2022).

What to Look for in a Great Currency Converter Tool

Not all converters are created equal. A basic tool might be fine for a quick check, but for serious use, you need more power. Here’s my checklist:

- Live Mid-Market Rates: This is non-negotiable. Ensure the tool pulls from a live data source, not one that’s updated once a day.

- Historical Data Charts: The ability to see trends over a week, month, year, or even five years is crucial for business and investment decisions.

- Low/High Alerts: The best tools let you set an alert, notifying you when a currency pair hits a specific rate you’re waiting for.

- Offline Mode: For travelers, this is a lifesaver. The app should store the last updated rates so you can use it without an internet connection.

- Fee Calculator: Some advanced tools (like those from Wise) allow you to input a bank’s percentage fee to see the *actual* rate you’ll receive, moving beyond the mid-market benchmark.

- Broad Currency Support: It should include not just major currencies but also minor ones and even cryptocurrencies if that’s relevant to you.

Conclusion: Your Financial Passport to the World

As we’ve seen, the uses of a currency converter go far beyond simple arithmetic. It’s a tool of financial empowerment. It gives the traveler confidence, the shopper an edge, the freelancer security, and the business owner a critical data point for survival and growth.

The next time you plan a trip, invoice a client, or shop on an international site, don’t just guess. Take the 10 seconds to check the real rate. Understand the difference between the number on the screen and the money in your pocket. By embracing this simple tool, you’re not just converting currencies; you’re converting confusion into clarity and potential losses into savvy savings.

Frequently Asked Questions (FAQs)

Online converters show the mid-market rate, which is the direct, wholesale rate without any fees. Banks, PayPal, and credit card companies add a ‘spread’ or margin to this rate as their fee for the service. So, the rate they offer you will always be slightly worse than the mid-market rate. Your goal is to find the service with the smallest spread.

Exchange rates in the Forex market change every second during market hours. For major currency pairs like EUR/USD, the value can fluctuate significantly throughout the day due to economic news, political events, and market sentiment. That’s why using a converter with live, real-time data is so important for any significant transaction.

In most cases, it is significantly cheaper to withdraw local currency from a reputable bank’s ATM when you arrive at your destination than to exchange a large amount of cash at home or at an airport kiosk. While your bank may charge a small foreign ATM fee, the exchange rate you get is typically much closer to the mid-market rate. Use a currency converter to estimate the cost before you go.

Absolutely. One of the key uses of a currency converter for investors is to calculate the ‘real’ return on foreign assets. You must convert both the initial purchase price and the current market value of your foreign stock or bond back into your home currency to understand how exchange rate fluctuations have impacted your overall profit or loss.

The most common and costly mistake is accepting Dynamic Currency Conversion (DCC) when paying with a card abroad. This means choosing to be billed in your home currency instead of the local currency. This allows the merchant’s payment processor to apply a very poor exchange rate, often adding 7-12% to your bill. Always choose the local currency.