Ever feel like loans are a financial black box? Honestly, they don’t have to be. Taking out a loan is a huge decision, whether it’s for that dream home, a shiny new car, or investing in your education. But the repayment part? That can feel overwhelming. Forget those days of struggling with complex formulas! The EMI Calculator is here to change the game.

Understanding the use of an EMI Calculator is key to staying financially healthy while managing debt. It’s not just about knowing your next payment. It’s about understanding how interest rates, loan terms, and the initial loan amount all work together to shape your financial future. In this guide, we’ll dive into how this tool works, why it’s so beneficial, and how to use it strategically. Let’s get started!

What is an EMI Calculator and How Does It Work?

An EMI Calculator is an automated tool that figures out your Equated Monthly Installment (EMI). This is the fixed amount you pay back to the lender each month. These installments cover both the interest and the principal, ensuring your loan is paid off completely over the agreed-upon term. Simple, right?

The main job of an EMI Calculator is to simplify a pretty complex amortization formula. Sure, you *could* do it manually. But the formula involves exponents, which aren’t exactly calculator-friendly. Trust me, I’ve been there!

Here’s the formula, if you’re curious:

E = P x R x (1+R)^N / [(1+R)^N-1]

- E is the EMI.

- P is the Principal Loan Amount.

- R is the monthly interest rate.

- N is the loan tenure in months.

Just plug in those numbers, and the EMI Calculator spits out the exact amount you need to budget for. No more guessing, no more errors.

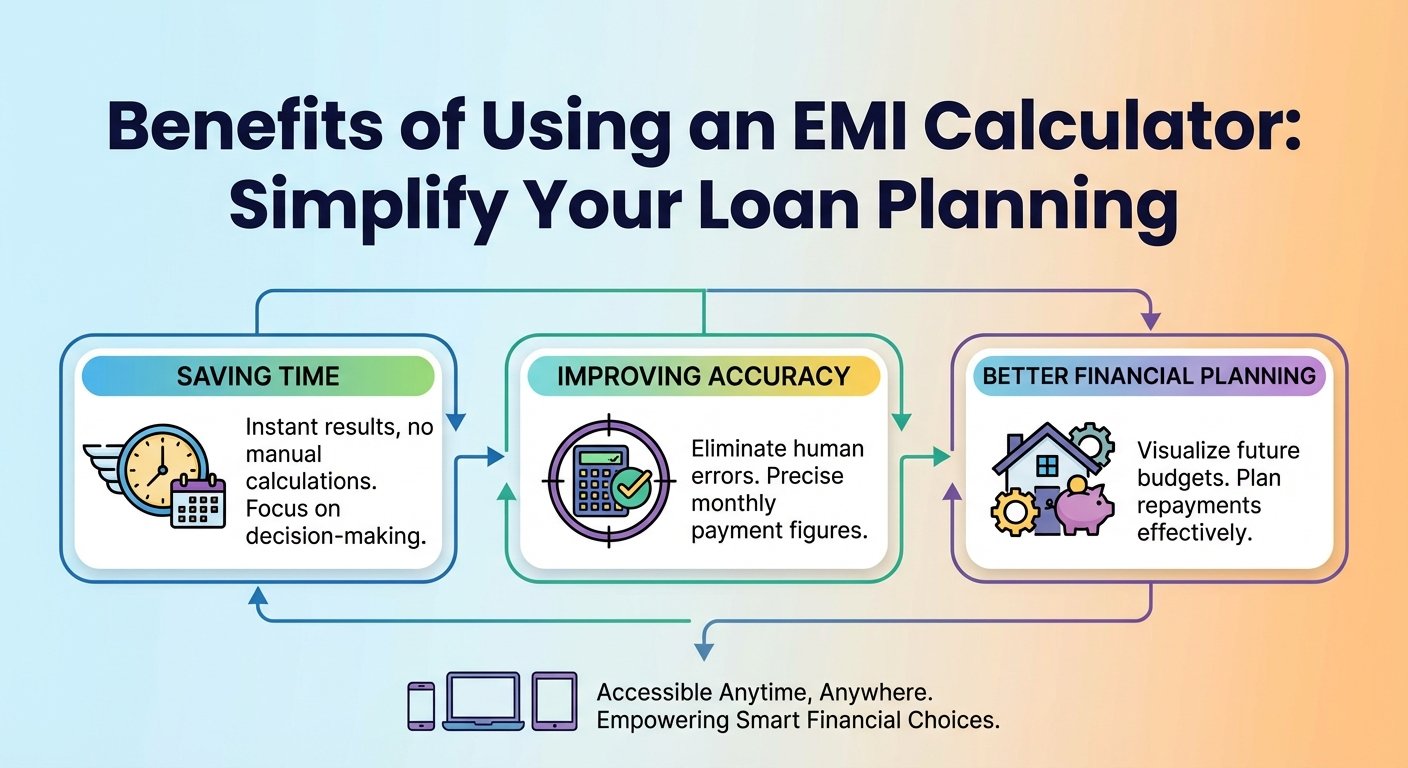

Precision & Accuracy

Forget manual calculations that are prone to errors, especially with changing interest rates. An EMI tool? It guarantees mathematical accuracy, every single time.

Time Efficiency

Instead of wrestling with spreadsheets for hours, you get instant results. This lets you quickly compare different loan options in minutes.

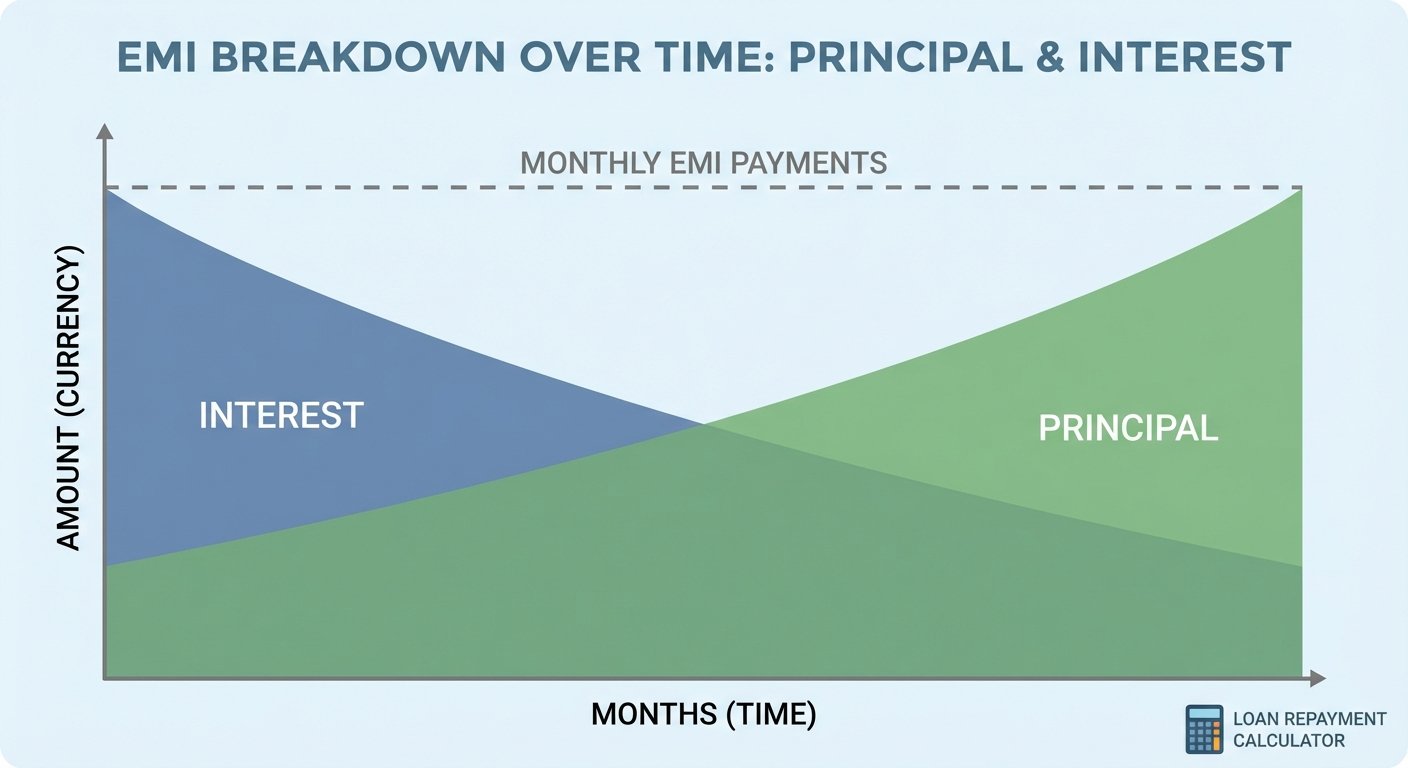

Financial Transparency

It breaks down your total payment into interest and principal. You see exactly where your money is going. That’s empowering, isn’t it?

Why You Should Use an EMI Calculator Before Applying for a Loan

Here’s the deal: Many borrowers focus on the loan amount first and *then* think about the EMI. Big mistake! This often leads to financial stress later on. The best part about an EMI Calculator? It lets you work backward. You decide what you can comfortably pay each month and then adjust the loan term or principal amount accordingly.

Using an EMI Calculator helps you figure out what you can actually afford. Financial experts often say your total EMIs shouldn’t be more than 40-50% of your monthly take-home pay. This tool helps you find that sweet spot where you can repay your loan without sacrificing your lifestyle or other financial goals.

And when you’re thinking about your long-term financial health, it’s important to see the bigger picture. While you’re looking at your debt, you should also be thinking about your investments. Maybe check out how to calculate SIP returns with inflation to make sure your wealth is growing as fast as your debt is shrinking.

Understanding the Components of an EMI Calculator

To really get the most out of an EMI Calculator, you need to understand how each part affects the outcome:

- Principal Amount: This is how much you’re borrowing. Plain and simple, the higher the principal, the higher the EMI.

- Interest Rate: This is the cost of borrowing money. Even a tiny difference of 0.5% can have a big impact on the total interest you pay over a long loan term, like 20 years.

- Tenure: This is how long you have to repay the loan. Now, this is where it gets interesting. A longer tenure means a lower monthly EMI, which seems great. But it also means you’ll pay *way* more in interest to the bank over the life of the loan. It’s a balancing act.

Strategic Planning: How to Save Interest Using an EMI Calculator

Most people use the calculator once and then forget about it. But here’s the thing: the *real* power of an EMI Calculator is in running different scenarios. You can use it to figure out how to save money on interest payments. Seriously.

Take a home loan, for example. Use the calculator to see what happens if you make a partial prepayment. If you get a bonus at work, use some of that to pay down your principal. The calculator will show you how much shorter your loan term will be, and how much you’ll save in interest. This is often called an amortization schedule.

And if you’re a business owner managing cash loans, staying organized is crucial. Using a cash counter calculator alongside your loan planning helps make sure your cash flow matches your repayment schedule.

Types of Loans You Can Plan With an EMI Calculator

While the basic math is the same, different loans have different purposes. The EMI Calculator helps you understand the nuances of each.

Home Loans

These are long-term, like 15-30 years. The calculator helps you decide whether you want a lower EMI with higher interest or a higher EMI to pay it off faster.

Car Loans

Usually shorter, maybe 3-7 years. Here, the calculator is essential to make sure your car isn’t losing value faster than you’re paying off the loan. No one wants to be upside down on their car loan!

Personal Loans

These often have high-interest rates, which makes them risky. The tool helps you see just how much that discretionary spending is *really* costing you.

Home Loan vs. Personal Loan EMI Calculator Differences

While a standard EMI Calculator works for most loans, the context matters. Home loans often have variable interest rates, so your EMI could change. Personal loans usually have fixed rates. If you’re using the calculator for a home loan, add a little extra to the interest rate to see if you can still afford the EMI if rates go up. Better safe than sorry, right?

For a deeper dive into how loan amortization works, check out Investopedia’s Guide on Amortization.

Common Mistakes to Avoid When Using an Online EMI Calculator

The tool itself is accurate, but your inputs might not be. Here are some common mistakes to watch out for:

- Ignoring Processing Fees: The EMI Calculator usually just looks at the principal and interest. It doesn’t include processing fees, insurance, or other charges. Factor those in separately.

- Confusing Flat Rate vs. Reducing Balance: Some lenders advertise a “flat” interest rate, which looks lower but is calculated on the *entire* principal for the whole loan term. The standard EMI Calculator uses the “reducing balance” method (which is the norm). Make sure you know which one your lender is using.

- Overlooking Prepayment Charges: Planning to pay off the loan early? Check for penalties. The calculator assumes you’ll pay as scheduled, unless you use a specific prepayment calculator.

Advanced Tips for Loan Management

Just because you’ve got the loan doesn’t mean the EMI Calculator is useless. It’s still a great tool for refinancing. If interest rates drop, use the calculator to see if switching to a new lender (balance transfer) makes sense, even with the fees. Compare your current EMI with the potential new one and make a smart decision.

Also, a good credit score is essential for getting those lower rates. Understand how your debt-to-income ratio (which you can figure out with your EMI and income info) affects your creditworthiness. You can learn more about credit management at Bankrate.

Conclusion

The EMI Calculator is way more than just a number cruncher; it’s a vital tool for understanding and managing your finances. It gives you the clarity and accuracy you need to plan ahead and puts you in control. Whether you’re buying a house or consolidating debt, using this tool wisely ensures you’re managing your loan, not the other way around. Before you sign anything, play around with an EMI calculator to explore all your options. Your financial peace of mind is worth it.

Frequently Asked Questions

Yes, a standard EMI calculator works for home loans, car loans, personal loans, and education loans, as long as the loan uses a reducing balance interest method. Credit card dues and flat-rate loans need a slightly different calculation.

The calculator gives a very close estimate of your monthly payment based on the principal, interest, and loan term. But, the bank might charge a slightly different amount due to service taxes, admin fees, or changes in variable interest rates.

A longer loan term lowers your monthly payment, making the loan seem more affordable. However, you’ll end up paying much more in total interest over the life of the loan. A shorter term increases your EMI but saves you money on interest.

A flat interest rate is calculated on the original loan amount for the entire term, leading to higher payments. A reducing balance rate is calculated only on the outstanding principal each month. Most EMI calculators use the reducing balance method.

Definitely! Use the calculator to see how your loan term or EMI changes if you reduce the principal. This is a great way to see how much you can save by making extra payments during the loan.